Miami Real Estate: 2025 Recap & What to Watch in Q1 2026

Miami in 2025 didn’t feel like “boom” or “bust.” It felt like something more mature: a market recalibrating. Buyers were pickier, sellers had to be sharper, and the homes that nailed price + condition + location still moved.

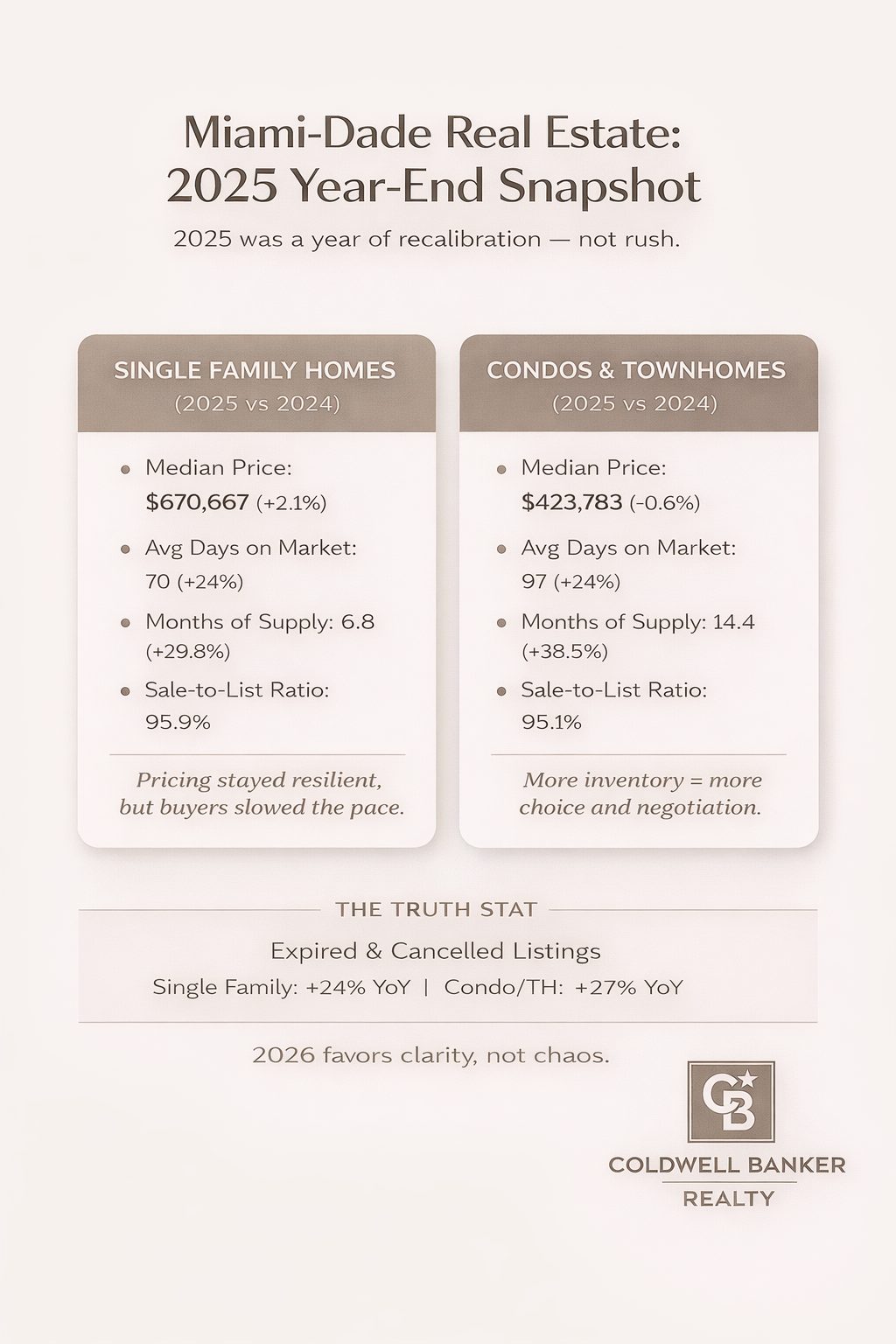

Here’s the year-end story (Miami-Dade County), broken down by Single Family vs Condo/Townhome, plus the early signals I’m watching as we move into Q1.

The quick take (TL;DR)

-

Prices held up (SFH slightly up, condos basically flat), but…

-

Homes took longer to sell and inventory rose, which created more negotiation.

-

Expired/cancelled listings jumped — a nice way of saying: pricing strategy mattered a lot.

2025 vs 2024 — Single Family Homes (Miami-Dade)

Pricing stayed resilient, but the pace slowed.

2025 highlights (vs 2024):

-

Median sale price: ~$670,667 (+2.1%)

-

Closed sales: 10,006 (-5.3%)

-

New listings: 19,619 (+6.1%)

-

Avg days on market: ~70 days (+24%)

-

Months of supply: ~6.8 (+29.8%)

-

Sale-to-list ratio: ~95.9% (slightly down)

What that means in real life:

Single family remained the “stronger” segment, but buyers weren’t rushing. More inventory + longer DOM = more space for inspections, credits, and real negotiation — especially when a home felt overpriced or needed work.

2025 vs 2024 — Condos & Townhomes (Miami-Dade)

Condos/townhomes felt slower — and the stats match that vibe.

2025 highlights (vs 2024):

-

Median sale price: ~$423,783 (-0.6%)

-

Closed sales: 10,958 (-10.6%)

-

New listings: 29,974 (basically flat)

-

Avg days on market: ~97 days (+24%)

-

Months of supply: ~14.4 (+38.5%)

-

Sale-to-list ratio: ~95.1% (slightly down)

What that means in real life:

Condos and townhomes became more “choosey buyer” territory. With higher supply and longer time-to-contract, the winners were the units with strong value: clean condition, clear HOA story, competitive pricing, and a lifestyle angle that actually sells (walkability, light, views, outdoor access, amenities that people use).

The stat that tells the truth: Expired & Cancelled Listings

This is the market’s way of saying: “Nice try.”

-

SFH expired/cancelled: +24% YoY

-

Condo/TH expired/cancelled: +27% YoY

Translation: buyers were paying attention, and the market didn’t reward wishful pricing. The homes that sat weren’t always “bad” — they were usually just mispositioned.

What I’m watching for Q1 2026 (Miami-specific signals)

Q1 is quietly one of the most strategic times in Miami, because people make decisions with less noise.

Here are the early signals I’m watching:

1) Negotiation windows stay open (especially condos)

Sale-to-list ratios hovering mid-95% range tells us the “offer stage” has real leverage — but it’s still a market that rewards being smart, not aggressive for sport.

2) Inventory is the story

-

SFH months supply is higher than last year (more choice for buyers)

-

Condo/TH months supply is very elevated (buyers have options)

That usually means: condition + pricing + presentation matter more than ever.

3) The “rushed buyer” is fading

In 2025, we saw less frenzy and more intentional decision-making. If 2024 was reaction-mode, 2025 was recalibration. Q1 tends to bring buyers back with clearer priorities — especially after holiday pause.

What this means for you

If you’re buying

This is a good season for clarity and leverage. You don’t need to rush — you need a plan:

-

target neighborhoods that match your lifestyle (not just a Zestimate)

-

be ready to move fast on the right home

-

negotiate calmly (inspection credits, closing costs, price)

If you’re selling

The market still rewards sellers — when the home is positioned correctly:

-

price based on current buyer behavior, not last year’s headlines

-

prep like you’re competing (because you are)

-

make it easy to say yes (clean disclosures, clean listing, clean vibe)

My bottom line

2025 was the year Miami buyers got their attention span back. And honestly? Same. 😄

Q1 2026 looks like a market where the best results come from being present, grounded, and strategic — not rushed.

If you want the short version for your specific neighborhood (Coral Gables / Pinecrest / Grove / etc.), message me and I’ll pull the micro-trend view.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link