The national housing market is shifting again — and Miami is feeling the ripple.

Existing-home sales just hit a seven-month high, mortgage rates have eased for a third straight week, and inflation ticked slightly higher — setting the stage for what could be a more balanced close to 2025.

So what does this all mean for us here in Miami-Dade? Let’s break it down.

🔹 National Snapshot: A Market Catching Its Breath

-

Existing-home sales rose 1.5% month-over-month and 4.1% year-over-year in September (NAR).

-

Median national price: $415,200 (+2.1% YoY).

-

Mortgage rates: Now averaging 6.19% (30-year fixed) — the lowest in over a year.

-

Inflation: 3% overall, with the Fed expected to cut rates by 25 bps this week to help cool the labor market.

👉 What this means: Lower borrowing costs are already reigniting buyer activity nationwide — but buyers remain value-conscious, and sellers must price smart to compete.

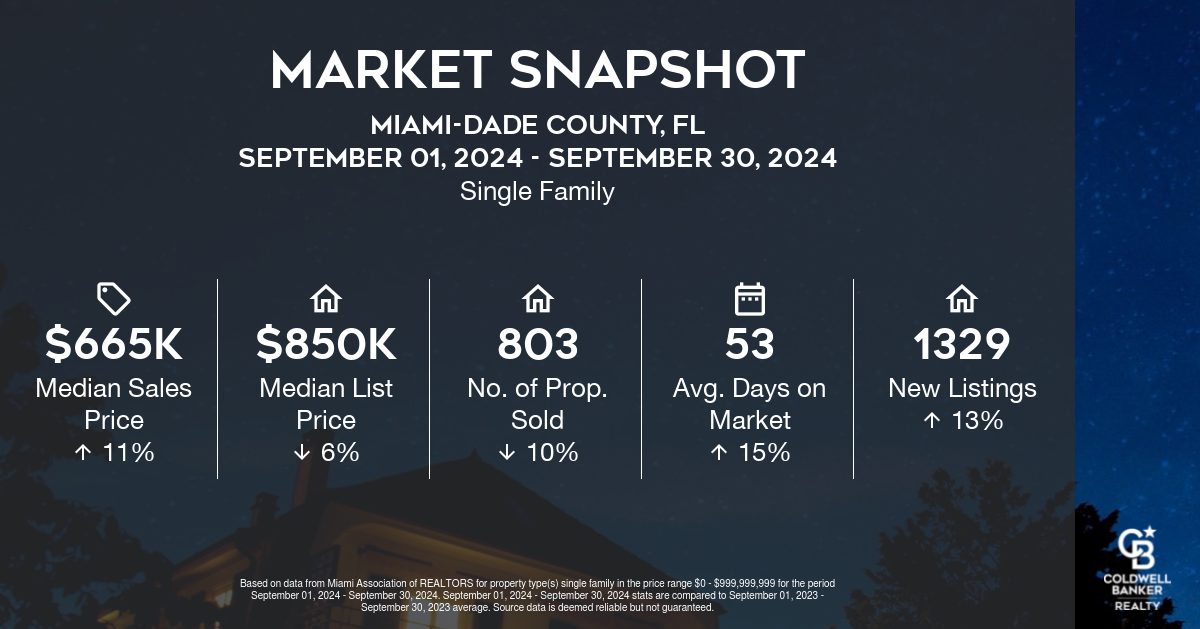

Miami-Dade Market Deep Dive

🔍 What We’re Seeing in Miami

After nearly two years of relentless price growth, Miami’s market is recalibrating:

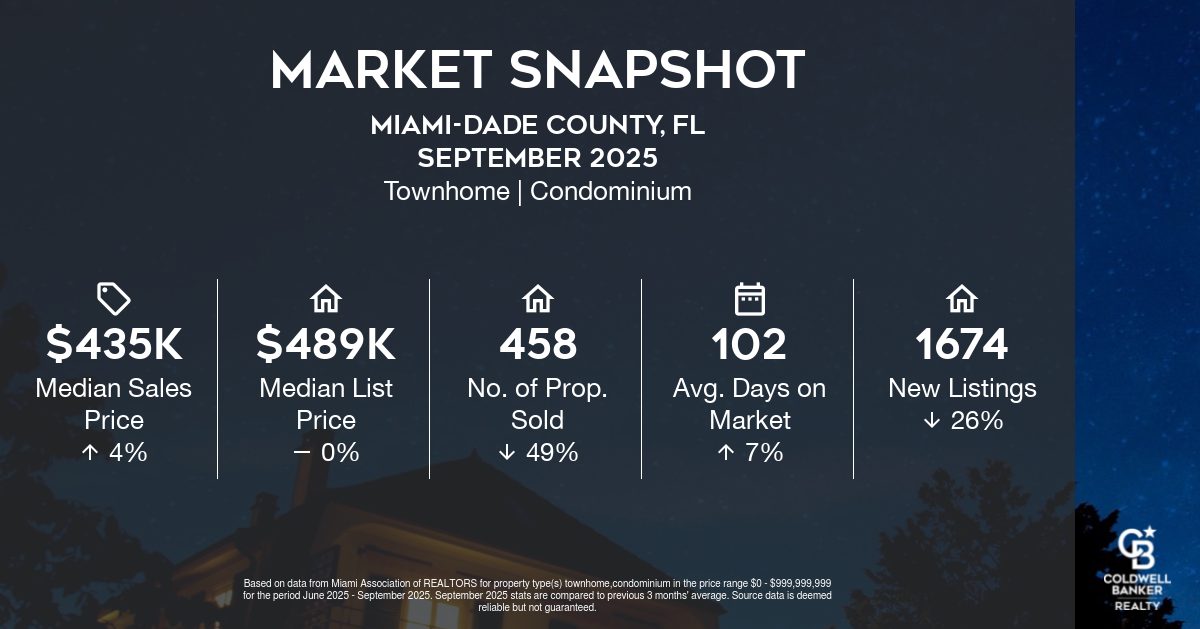

- Inventory is tightening, especially in the townhome / condo segment (down 26%), which is keeping prices relatively stable even as sales slow.

- Days on market are stretching slightly — buyers have more breathing room to negotiate and compare.

- Condos under $500K are holding steady, while single-family homes remain in high demand under $1 million, though price growth is easing.

- Cash buyers and investors are still active, but more selective — focusing on rental potential, not just appreciation.

For Buyers

Falling rates are your cue to re-enter the market. Even a 0.25-point drop in rates can add thousands in buying power. With more listings to choose from and less competition than last year, this is a window to shop smartly — especially if you’ve been waiting for a cool-down.

For Sellers

Pricing is everything right now. Buyers are cautious, and homes that sit too long end up getting discounted. If you’re thinking about listing, a data-backed pricing strategy (not just Zillow’s guess) will help you stand out — particularly as new inventory ebbs and flows.

For Investors

The slowdown in sales volume is creating opportunity. Rental demand remains strong, and condo / townhome prices have plateaued — a sweet spot for long-term cash-flow buyers who missed the 2021–2022 run-up.

The Bottom Line

Miami’s market isn’t “crashing” — it’s correcting. And that’s healthy. A small rate dip, steadier prices, and a return to normal inventory levels make this an ideal moment for buyers to act strategically and for sellers to list smart.

As we head into the holidays, expect more motivated buyers and sellers looking to close before year-end — and I’ll keep you posted with how the numbers shift on the ground here in Miami.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link